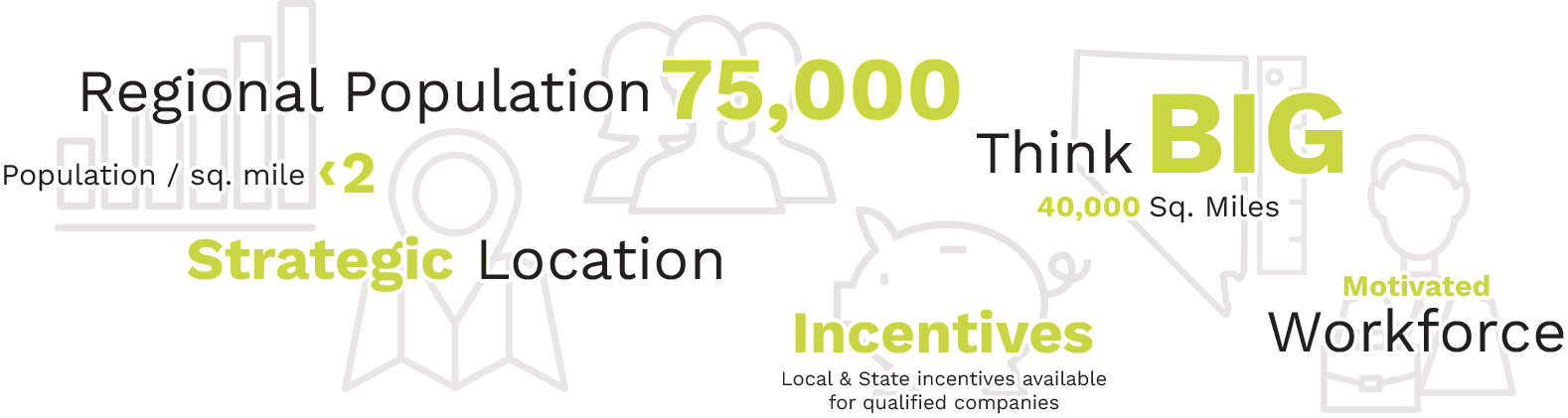

Incentives & Financing

Incentives and Financing

The State of Nevada, through the Governor’s Office of Economic Development, offers a variety of incentives to help qualifying companies make the decision to do business in the state, including sales tax abatements on capital equipment purchases, sales and use tax deferral on capital equipment purchases, abatements on personal and modified business taxes, real property tax abatements for recycling, assistance with the cost of intellectual property development, and employee training grants. The State now offers abatements on aviation parts and data centers, as well.

In addition, various Counties and Communities may also offer an incentive package depending on the economic impact of the prospective company. These incentives may include a reduced price on industrial land, waiving of utility hookup fees, or assistance in infrastructure development.

How Do You Qualify?

If you can answer yes to these three questions, then you are likely eligible for one of our very competitive incentive packages:

- Will your company export at least 50% of its product outside of the State of Nevada?

- Will you create at least 10 new jobs?

- Will you provide a minimum average wage of $24.16/hr. along medical/health insurance?

If you answered yes to all three of these questions, you need to Contact Us.

A basic overview of State incentive benefits and requirements can be found in the Nevada Urban/Rural Incentive Guide.

Rural Nevada Development Corporation

The Rural Nevada Development Corporation (RNDC) is a non-profit development corporation formed in January of 1992 to serve the fifteen counties of Rural Nevada as well as the rural portions of Clark and Washoe Counties and the twenty-seven Indian Tribes of Nevada. RNDC is headquartered in Ely, Nevada.

Battle Born Growth

The Nevada State Small Business Credit Initiative (SSBI), also known as “Battle Born Growth” is an initiative made up of various microloan and venture capital programs designed to jump start your small business. Explore your support options today

Sales and Use Tax Abatement

Sales and use tax abatement on qualified capital equipment purchases, with reductions in the rate to as low as 2%.

Modified Business Tax Abatement

An abatement of 50 percent of the 1.475% rate on quarterly wages exceeding $50,000.

Personal Property Tax Abatement

An abatement on personal property not to exceed 50% over a maximum of 10 years.

Real Property Tax Abatement for Recycling

Up to 50% abatement for up to 10 years on real and personal property for qualified recycling businesses.

Data Center Abatement

An abatement up to 75% for personal property and reduction of sales tax to 2%.

Aviation Parts Abatement

Personal Property Tax abatement up to 50% and Sales and Use Tax reduction to 2%.

Silver State Works Employee Hiring Incentive

Employers can receive as much as $2,000 for each state-qualified employee hired.

Local Incentives

Depending on where you choose to relocate, there may be some local County or City incentives available to you.