Business Start Up

Business License and Taxation Requirements

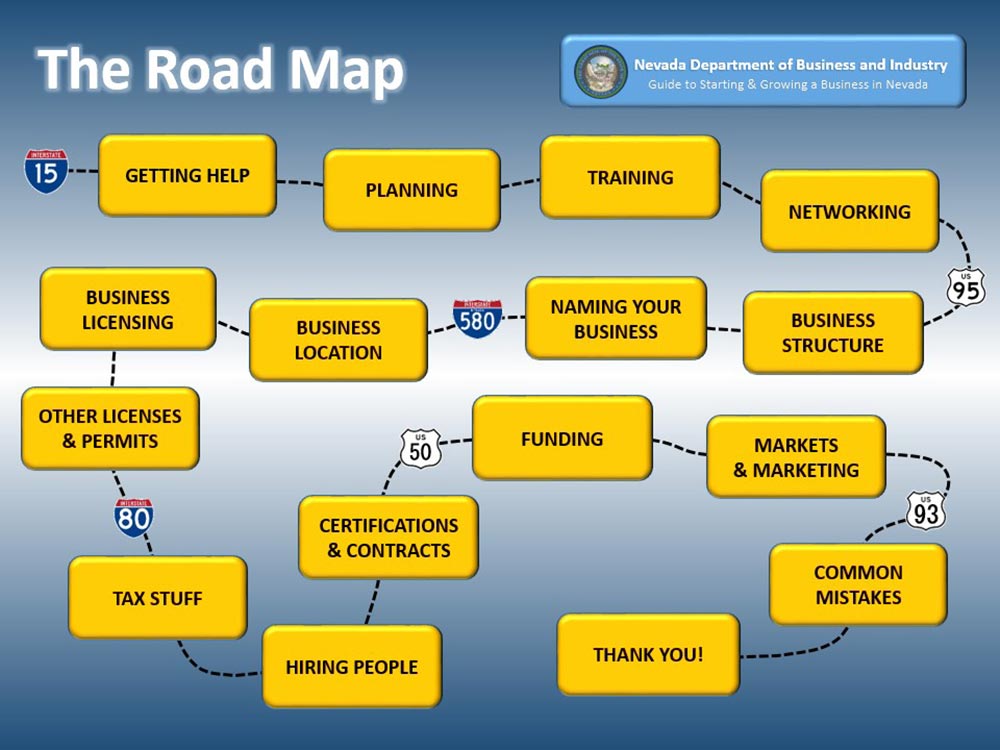

A business license is needed for each person, corporation, partnership, proprietorship, business association and any other similar organization that conducts an activity for profit, including an independent contractor or sole proprietor. A trade show or convention held in this state in which a business previously described takes part, or in which a person who conducts such a business attends, for a purpose related to the conduct of the business also needs a business license. The Nevada Department of Business and Industry have developed a user friendly road map to assist future companies in their pursuit to do business within the State of Nevada. This can be found by clicking the road map image.

Federal Employer Identification Number

Every partnership or corporation must have an Employer Identification Number (EIN) to use as its taxpayer number. Sole proprietors must also have an EIN if they pay wages to one or more employees or if they are required to file any excise tax returns.

LEARN MORE

Nevada State Business License

All businesses operating in Nevada must obtain a State Business License issued by the Secretary of State’s office.

LEARN MORE

The Secretary of State’s Office offers an online tool known as Nevada Silver Flume for those wishing to set up their Nevada State business license online.

LEARN MORE

Nevada Department of Taxation

If you own a small business you will need to manage your business tax filings with the Nevada Department of Taxation.

LEARN MORE

County/City Business License

Depending on where you’re operating your business, a specific County or City may require a Business License to operate in their jurisdiction.

Fictitious Names

A fictitious name/dba certificate is required for all businesses that plan to use a name different than their legal or corporate name. It is best to check with the County Clerk’s office where your business is located to determine if the fictitious name desired is available.

Zoning Requirements

The applicable city or county zoning ordinances should be checked to ensure that the desired location is zoned for the proposed type of business before buying or leasing property. For home-based businesses, please verify if a Home Occupation Permit will be required. Contact your local government office(s), or you may find the applicable zoning office(s) in the limited list above under Local Business License Offices.

Business Personal Property Declaration Form

Nevada tax laws require all persons, firms, or businesses owning, renting, leasing, or controlling business personal property to file a Business Personal Property Declaration Form. Please contact your city or county government office for more information.

I-9 Forms for New Employees

Every employer is required, within 72 hours of hiring a new employee, to maintain a completed, signed, witnessed, and dated I-9 Form for each employee.

LEARN MORE

W-4 Form

Every employee hired is to complete a W-4 Form so that the employer can withhold the proper amount of income tax from each paycheck. Any change in the employee’s tax status requires a new form.

LEARN MORE

Workers Compensation Insurance

Every business that employs anyone must by law, obtain workers compensation insurance coverage unless that entity is certified by the Commissioner of Insurance as a self-insured employer.

LEARN MORE

Nevada Unemployment Compensation Program

Any business that employs one or more workers is an “employing unit” and must register with the Nevada Unemployment Compensation Program. Registration is made by submitting a Nevada Business Registration Form to the employment security division as soon as workers are hired.

LEARN MORE

Nevada Labor Statutes

All employers must comply with Nevada’s Labor Statutes and must post a sign explaining these laws at the place of business.

LEARN MORE